Each quarter and at the end of each year, you should receive this document from the investment company that manages your pension account. Many people, including us in the past, would just ignore it and forget about it. However, not knowing what’s going on in your pension can be costly. You may be paying exorbitant management fees or might not be in an investment track that meets your needs. Additionally, employers can make mistakes, including not depositing their portion on time, in full, or at all.

Every month, your employer is legally required to deduct 6% (or 7% if you choose) of your gross salary and deposit it into your pension account in addition to their own contribution. In this post, we are going to break down a typical Israeli pension statement and show you how to read it.

Disclaimer: We are not financial advisors. Everything said here and on this blog is our own option and not meant to be advice on what you should or should not do.

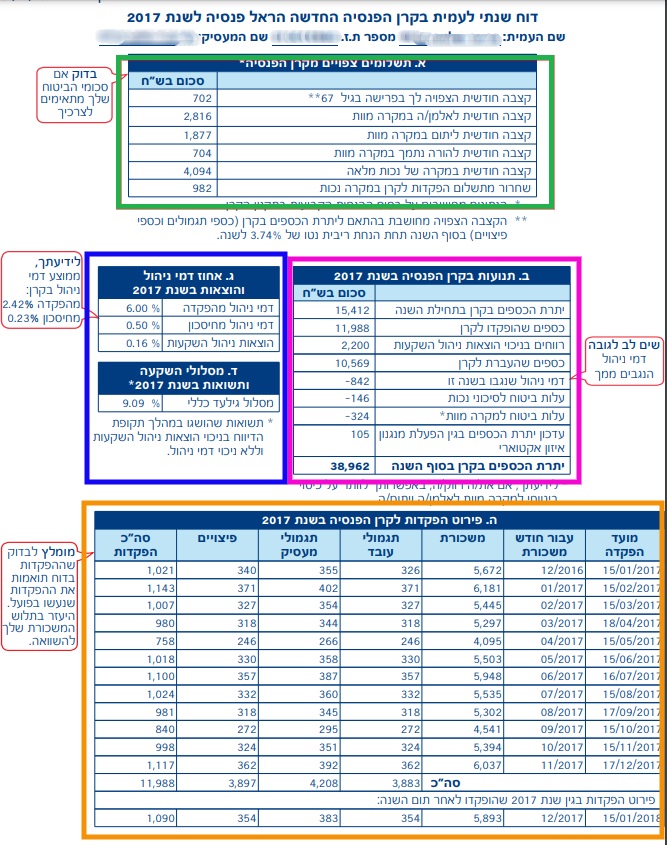

This is what an Israeli pension statement looks like. If you have never looked at yours, or even if you have, it could be a good idea to go download yours from your pension website so that you can follow along, or you can go over your own afterwards.

One thing we appreciate is the helpful bubbles next to each section, alerting you what to look out for. We’ll translate each one for you below next to the headers. We color-coded this example statement for your convenience. Match the colored boxes to the colored headers below.

Expected payments (תשלומים צפויים מקרן הפנסיה) – Check that the insurance amounts meet your needs

In this section, we can see the monthly payouts you could expect to receive if you stopped depositing into your pension today and never touched it again. Since most Israeli pension plans also include life insurance and disability insurance, this section also delineates the expected monthly payments that you or your family members would receive in the event of your death or disability.

If our example employee stopped depositing into his pension account and let it continue compounding until retirement, he could expect to receive 702 shekels per month at age 67.

In the tragic event that our friend dies prematurely, his spouse would receive 2,816 shekels per month, his children would receive 1,877 shekels per month, and if he has an elderly parent as a dependent, they would receive 704 shekels per month.

If our friend were to become temporarily or permanently disabled to the extent that he is unable to work, this insurance would pay him a stipend of 4,094 shekels per month. Not only that, but the insurance would pay his pension company 982 shekels per month to cover the monthly deposits that our friend and his employer aren’t paying during that time. This way, come retirement, his pension savings will be there for him.

Transactions in your pension account (תנועוות בקרן הפנסיה בשנת 2017) – Notice the percentage you pay in management fees

This section tells the story of your pension account during the reporting year. Our friend started 2017 with 15,412 shekels in his account. Over the course of that year, 11,988 shekels were deposited into the account. He earned 2,200 shekels in interest and also transferred over 10,569 shekels from a previous pension account. He was charged 846 shekels in management fees, 146 shekels for disability insurance, and 324 shekels for life insurance. He gained an extra 105 shekels because of an actuary recalculation. This left him with 38,962 shekels in his account at the end of the year.

Our friend is married with kids, but in the event that you are single and have no dependents, you can opt out of the life insurance portion of this policy and save yourself the money. If you choose to do this, you will need to reinstate it every two years.

Management fees (אחוז דמי ניהול והוצאות בשנת 2017) – FYI – The average management fee is 2.24% of deposits and 0.23% of your savings.

Pension companies tend to charge you fees on both your monthly contribution and annually on your total savings. While our friend here is paying the highest management fees permitted by law, make sure not to fall into that trap. Keep an eye on yours and keep them low. Today, with the government offering selected companies, it is easier to get your fees to be a lot lower.

Investment Track (מסלולי השקעות ותשואה בשנת 2017):

This shows you which track you are invested in and by what percentage it grew that year. Did you know that you can choose how your pension is invested? The default is always the most conservative track. If you have several decades between now and retirement, we suggest that you switch to a stock-based track. This way you will have more time to ride out the ups and downs of the stock market and have your money grow more.

Deposits made into your pension this year (Make sure these numbers match the sums that were actually deposited into your pension account. Use your tlush/payslip for reference.)

This section lists each of our friend’s deposits into his pension fund during that year. From right to left, the columns show: (1) date of the deposit, (2) the month’s salary that this deposit is for, (3) his gross salary for that month, (4) our friend’s deposit into his pension account, (5) his employer’s deposit into his pension account, (6) his employer’s contribution toward pitzuim (part of Seif 14) which also end up in his pension account, (7) the total amount deposited into our friend’s pension account. The last, separate line shows the pension deposit for December 2017 that was done in January 2018.

And that’s it!

We hope this guide helps you and empowers you to be more proactive and knowledgeable about your pension savings. Make sure to check out our other how-to guides. As we always say, knowledge is power! 🙂

Like what you see here? Subscribe so you never miss a post.

Leave a comment