Have you recently left your job or been laid off? Make sure to keep an eye out for your 161, which your former employer will send you. Like your Tofes 106, this is another important form to keep on file.

So what is it?

(Quick recap if you’ve missed it: As of 2014, employers must add to add your future severance pay (פיצויים) to your pension account on a monthly basis. This has become a significant component of retirement savings in Israel. While you may withdraw this money when you leave a job, your future self will greatly appreciate it if you leave it there and let it grow through the magic of compound interest. Check your contract and make sure it includes Section 14 (‘Seif 14’). This is huge.)

This form shows you how much severance pay your employer has deposited into your pension account and if any more will be added. Review your pension statements to ensure that your employer has deposited the correct amount each month.

The form is split into three parts.

- Part A/א. Employer declaration (הודעת המעסיק)

- Part B/ב. Your decision regarding your severance pay (הודעת העובד)

- Part C/ג. Your employer’s confirmation and submission (חישוב המעסיק, הנחיות לקופות הגמל ודגשים לעובד)

If you have recently received your 161, make sure you have it in front of you while we review the sections. As we say, “Knowledge is power.” Now let’s dive in!

Page 1

This section should be filled out by your employer. Let’s review it together and make sure the information is correct.

Part א1: Employee information (פרטי העובד). This will display your personal information: your name, date of birth, address, email, and phone number. There is also a box to check if you were an owner of the business or related to an owner of the business.

Part א2: Employer information (פרטי המעסיק). This shows information about the place you recently stopped working at. Details included here: The company’s tax number, its address, phone number, and email address.

Part א3: Reason for leaving (סיבת הפרישה). The options are (a) retirement/termination/quitting, (b) death, (c) disability.

Part א4: Dates of employment (תקופת העבודה). Start date, end date, total duration of employment.

Part א5: Gaps in employment / changes in position percentage / salary reductions (תקופות עבודה לא רציפות/ שינויים בשיעורי המשרה/ הפחתת שכר). Relevant info appears here.

Part א6: Employee’s salary (משכורת העובד). Your last regular monthly salary and your most recent salary, including severance pay.

Part א7: Budgetary pension (קצבה ממעסיק או משלם מטעמו). Just about no one gets this anymore. Move on.

Part א8: Future payments from your employer (מעניקי פרישה לשיעורין שישולמו בשנים שלאחר הפרישה). Any future payments that you will receive from your past employer should be listed here.

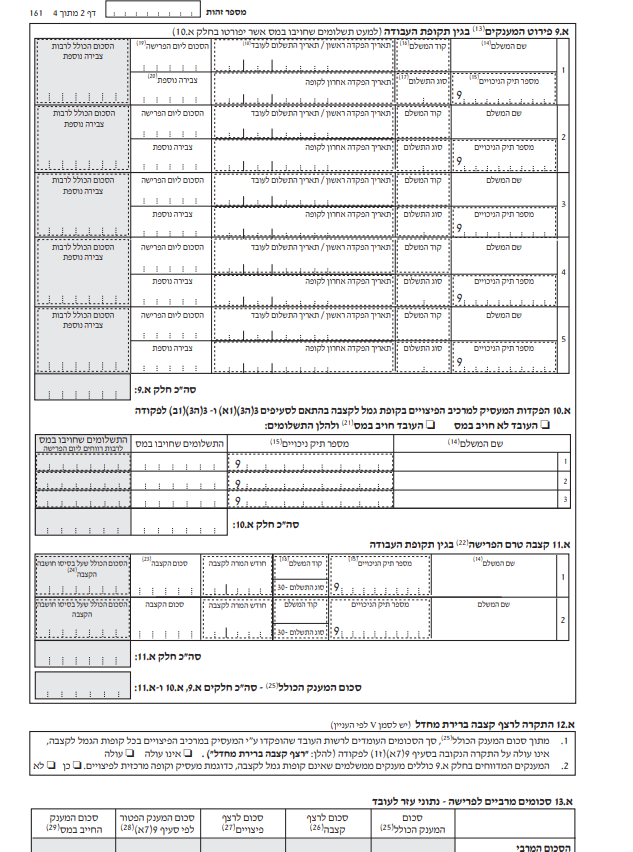

Page 2

Part א9: Bonuses and other one-time payments (פירוט המענקים בגין תקופת העבודה). This should include your pitzuim from your pension that was deposited by your employer (make sure everything was deposited by checking your last pension statement) and additional payouts like a מענק פרישה.

Part א10. Parts of payments made to your pitzuim that exceed the tax limit to your pension. (הפקדות המעסיק למרכיב הפיצויים בקופת גמל לקצבה). If you make a high income, this might be filled in. If not, it’s probably empty.

Part א11. Benefits that the employee received while employed. (קצבה טרם הפרישה בגין תקופת העבודה). The last line here also shows the sum of parts 9, 10, and 11.

Part 12א Tax Ceiling. התקרה לרצף קבצה ברירת מחדל. This shows whether the amount the employer deposited into the employee’s fund goes over the non-taxed amount by law.

Part 13א All deposits made into the employee’s funds. סכומים מירביים לפרישה – נתוני עזר לעובד. All amounts paid to the employee due to termination of employment.

Page 3

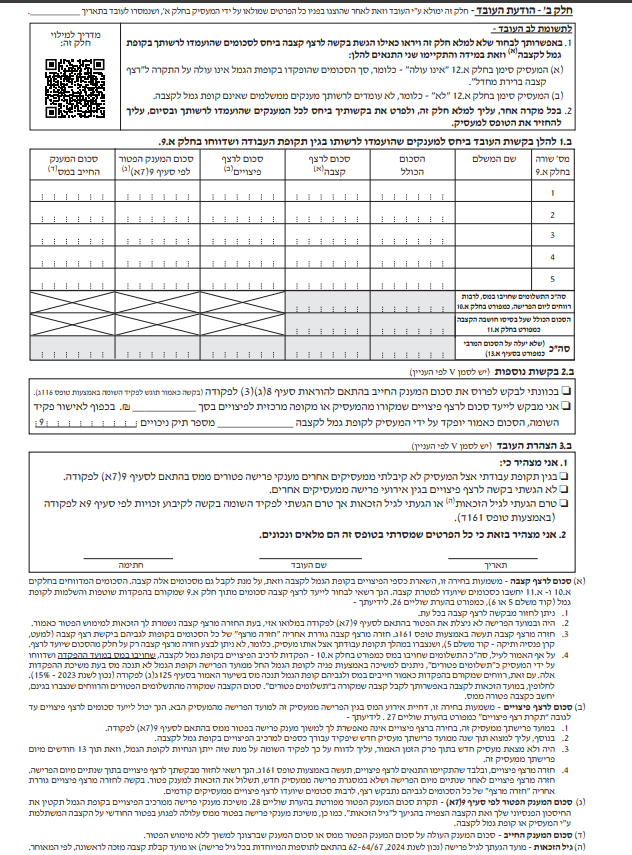

In this section you have the choice to withdraw your pitzuim or leave it to compound in your pension plan.

If you decide to withdraw this money, the top of this page needs to match section 9a. Contact the Tax Authority and inform them that you would like to withdraw your pitzuim. While you’re at it, consult with them to understand if and how it would be taxed. They will give you a confirmation document and inform your employer on how to fill this in. Once it’s filled in correctly, sign and date the bottom of the page under הצהרת העובד.

If you choose to leave the money to compound in your pension account (🎉), just skip to the end of the page and sign.

Page 4

After reviewing your submission, your employer fills out this page and submits it to the Tax Authority.

If you’re unsure about any section or what choice to make, consult your pension advisor before signing the form.

And that’s it! You’ve successfully completed your Tofes 161!

Onward and upward! Best of luck on finding your next job! You’ll do great. We know you will. ❤

What Israeli bureaucratic form should we dive into next?

Like what you see here? Subscribe so you never miss a post.

Leave a comment