If you’ve ever worked for an Israeli organization, you know that when you start a new job, or in January of each year, you are asked to fill out a 101 Form (Tofes 101). It’s a pretty long form which can be filled out by hand or digitally. But what exactly is it for? And why do you have to fill it out each year even if none of your answers changed? Read on to find out. We’re excited to tell you all about it in our latest post on Israeli employee rights.

This form will be provided to you by the payroll department. Think of it as part of your contract, as it ensures that you receive all the tax benefits to which you are entitled and the right amount of tax credits show up in your payslip.

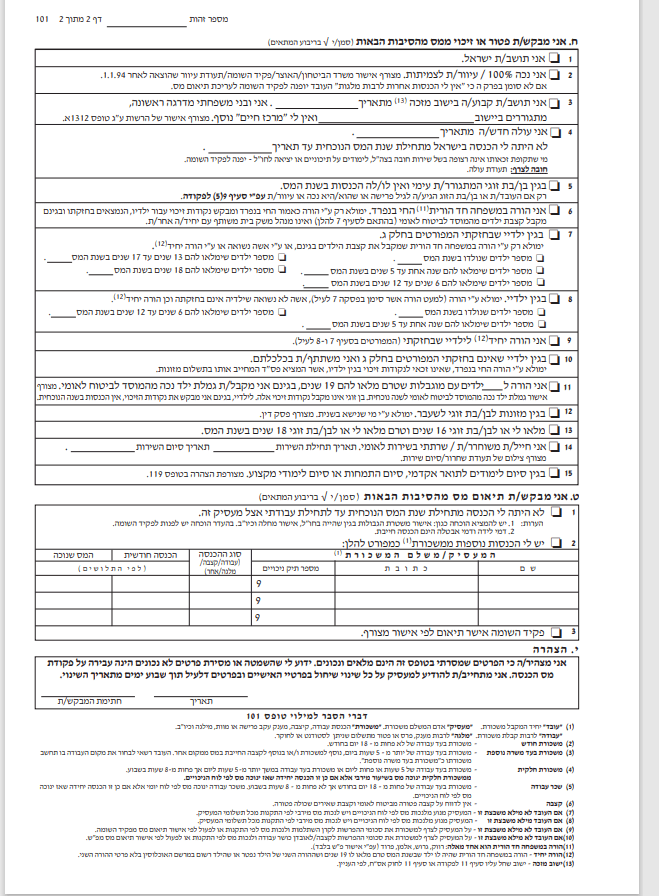

Does the image below look familiar? If you’ve ever filled out a 101 Form, it should. If it doesn’t, this post is extra important for you since you will likely be asked to fill one out soon. Read on and to learn all about what each section is for and how you are supposed to fill it out.

Section 1 (פרטי המעסיק) – Employer information. This should be filled out by your employer before you receive the form.

Section 2 (פרטי העובד/ת) –Employee information. This is you. Here, you need to fill in your ID number (mispar zehut), date of birth, date of aliyah, current address, gender, relationship status, whether you are a resident of Israel, whether you are a member of a kibbutz and if your salary is transferred to the kibbutz or is not, email address, phone number, and kupat cholim. All of this information is important to ensure that your employer pays the right amount of Bituach Leumi and income tax for you.

Section 3 (פרטים על ילדיי שבשנת המס טרם מלאו 19 שנה) – Information about your minor children. This is where you get to show off your pride and joy – your kids. Here, you list your children who are 18 and younger, as each child may entitle you to tax credits. Don’t make up extra kids though. Lying is a big no no and you can (and will) get caught. Put a check in column 1 next to the child’s information if they are in your custody. Put a check in column 2 if you receive kitzbat yeladim (child allowance from the government) for them.

Section 4 (פרטים על הכנסותיי ממעסיק זה) – Information about your earnings from this job. Here you select whether you work for this employer as a full time job, as a side job, if it’s part-time, shift work, a stipend, or a scholarship.

Section 5 (פרטים על הכנוסת אחרות) – Information about your earnings from other jobs. Here you need to declare any income you have from other jobs. The first option is if you do not work at any other place and want to get the full benefits from your current employer. If you do have an extra income, you need to declare what type of income you have, then indicate if you are receiving your tax credits from your other employer. If you are receiving the tax credits from a different employer, you need to do a teum mas and teum bituach leumi, to ensure that you don’t pay these taxes twice. The next squares indicate if they are paying into your pension and keren hishtalmut or not. Choose accordingly.

Section 6 (פרטים על בן/בת הזוג) – Information about your spouse. Only fill this part if in if you have a spouse. If you do, fill in their name, ID number, date of birth, whether or not they have an income, and if they do, what type.

Section 7 (שינויים במהלך השנה) – Changes that occurred during that tax year. Did you move to the periphery? Have a baby? Or do anything else that would change your tax credits? This is where you would draw extra attention to those changes. If you want to know what changes might get you tax credits, take a look at the Section 8 below.

Section 8 (אני מבקש פטור או זיכוי ממס מסיבות הבאות) – I am requesting a tax exemption or refund for the following reasons. (Check all that apply.)

1 – I am an Israeli citizen.

2 – I have 100% disability. (If so, you must attach confirmation from Bituach Leumi.)

3 – I live in a town that has an extra tax credit. (Make sure to fill in the date you moved in, add the name of the town, and include a confirmation of residency.)

4 – I am a new oleh/olah. (Make sure to include the date of your aliyah and the date you started working, and attach a copy of your Teudat Oleh. You’ll receive benefits for 42 to 54 months depending on when you made aliyah.)

5 – My spouse does not work and hasn’t earned any income this year. (This is only relevant if you or your spouse are at retirement age or `you declared a disability in part two above.)

6 – I am a single parent with custody of my children and receive kitzbat yeladim.

7 – The tax credits I receive for my children in my custody [listed in Section 3] have changed. (Here you mark if you had a new baby or any of your children turned 6, 13 or 18 that year.)

8 – The tax credits for my children not listed in section 7 have changed. (The changes are the same as the ones above.)

9 – I am my child(ren)’s only parent.

10 – I have children who are not in my custody for whom I pay child support. (These children should be listed in Section 3 above.)

11 – I am a parent of ___ child(ren) under the age of 19 with disabilities and receive Bituach Leumi benefits for them. (Include documentation from Bituach Leumi.)

12 – I am remarried and paying paying child support to my ex-spouse. (Include the court ruling.)

13 – I am or my spouse is between the ages of 16 to 18.

14 – I recently finished my military or national service (Thank you for your service! Make sure to include the dates of your service and your release letter.)

15 – I recently completed an academic degree.

Section 9 – (אני מבקש תיאום מס מסיבות הבאות) – I am requesting a teum mas for the following reasons. Here you fill out the information about your other employer. (Despite its confusing title, this is not your teum mas. You still need to do a teum mas separately.)

Section 10 (הצהרה) – Declaration. Here you sign that everything that you filled out is correct and that you will inform your employer of any future changes.

And that’s it! You’ve filled in your Tofes 101! 🎉

If you have any more questions about how to fill it in, speak to the person who handles payrolls at your place of work. They should be able to clarify any questions that may arise.

Like what you see here? Subscribe so you never miss a post.

Do you feel like you understand the Tofes 101 a little better now? What other employee rights posts would you like to see on our blog?

Leave a comment