You probably remember reading our guide on applying for your own tax return. (Hint: It’s an awesome guide that can get you money back from the government. If you haven’t read it yet, make sure to read it here.) To file for a tax return, you need a 106 form. But what exactly is it? And how do you read it? Read on to find out.

Your employer is required to give you the previous year’s 106 form by the end of March each year. It confirms all of the income you received and serves as a summary of all of your tlushim from that calendar year. This form is most commonly used when filing for a tax refund or for proving your income for things like arnona discounts.

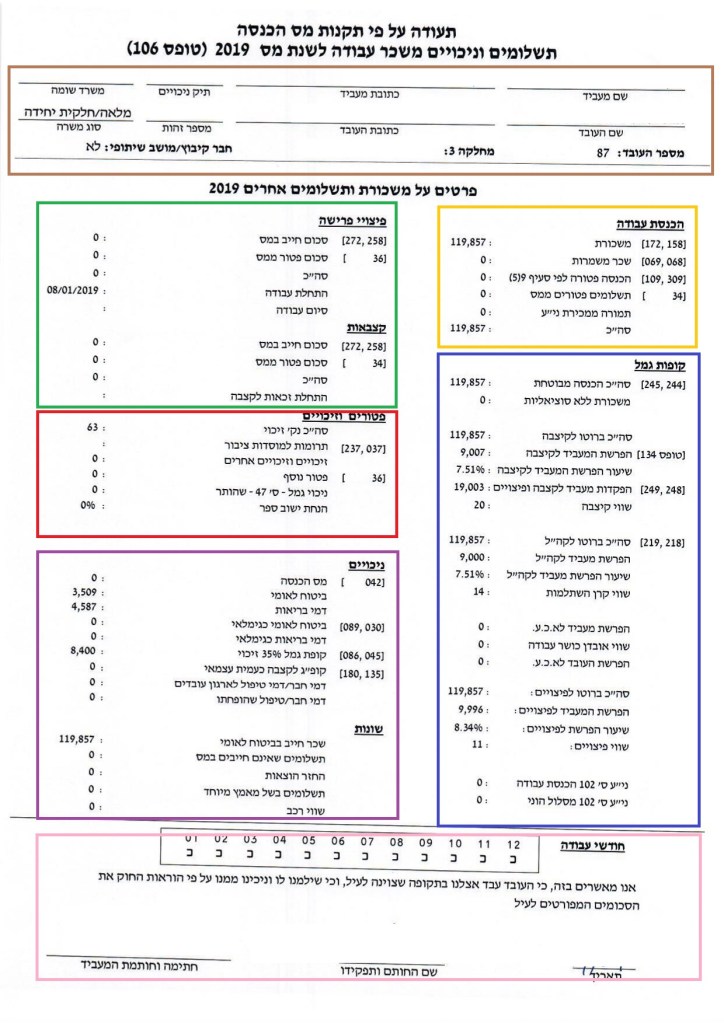

The form is divided into two columns. We’ve color-coded it to make it easier to follow.

Let’s start up top.

The brown section is pretty straight forward and shows which employer and which employee this form is talking about. It has your employer’s and your names, addresses, and identification numbers as well as your department and whether you are working full or part time.

Payments from your employer (הכנסת עבודה):

This is a summary of your taxable and non taxable income from you employer including your salary, value of benefits like company car, gifts, 10bis or Cibus, company meals, and other benefits.

Your employer’s deposits into your retirement and keren hishtalmut accounts (קופות גמל):

This section lists all of the deposits that your employer made into your pension and your keren hishtalmut.

It starts by showing you your total gross income again (שכר מבוטח ששילם המעסיק), followed by your employer’s contributions to your pension plan (הפרשת מעסיק לקצבה). The value of this should be 6.5% of your gross salary.

Next, it shows your employer’s contributions toward your keren hishtalmut (if you have one) (ברוטו לקה”ל ששילם המעסיק). This should be 7.5% of your gross salary.

After that, it shows your employer’s contributions toward your disability insurance (הפרשת מעביד לא.כ.ע). Unless you work in construction or another field that greatly increases your chance of work injuries, this is usually zero.

If you have Seif 14a in your employment contract, your employer pays your severance payments (סה”כ ברוטו לפיצויים) into your pension each month, which are yours whether you are fired or leave this job on your own accord. (That said, never withdraw your pitzuim if you can help it! Better to keep it compounding for the future.) This should be 8.33% of your gross salary.

Severance Pay (פיצויי פרישה) & Stipends (קצבאות):

The first section shows any severance pay you received from your employer that year. It will only be filled in if both of the following conditions are true:

(a) You retired or were laid off/fired from this company this year, and (b) you do not have Seif 14a in your employment contract (see above).

The second section refers to any other stipends you may have received to complement your severance pay. For most people, this is also zero.

Exemptions and Credits (פטורים וזיכויים):

This section sums all of the tax credits you are entitled to. The 106 form above belongs to a woman with two small children, who has 5.25 tax credits per month. The number above shows her tax credits for a year.

This section can also include tax refunds received for donating to charity, in the event that your employer takes of the tax refund for you. You might also be entitled to additional tax credits if you live in one of a list of peripheral towns.

Deductions (ניכויים):

Here you will see the deductions that came off of your salary, or in other words. This section shows how much money you paid for income tax, Bituach Leumi, health tax, your pension, and any union fees you might have paid.

Bottom Section

This shows the months that you worked that year and is signed off by your employer.

And that’s it!

This document is one of those important documents you should keep and back up for your records.

In case you’re wondering, you can find your 106 forms from the past 6 years here on the Tax Authority’s website.

We hope you found this Fionist Dream guide helpful. Make sure to check out our guides on how to fill out your 101 form and how to read your tlush. 🙂

What other guides would you like to see on our blog? Let us know in the comments.

Like what you see here? Subscribe so you never miss a post.

Leave a comment